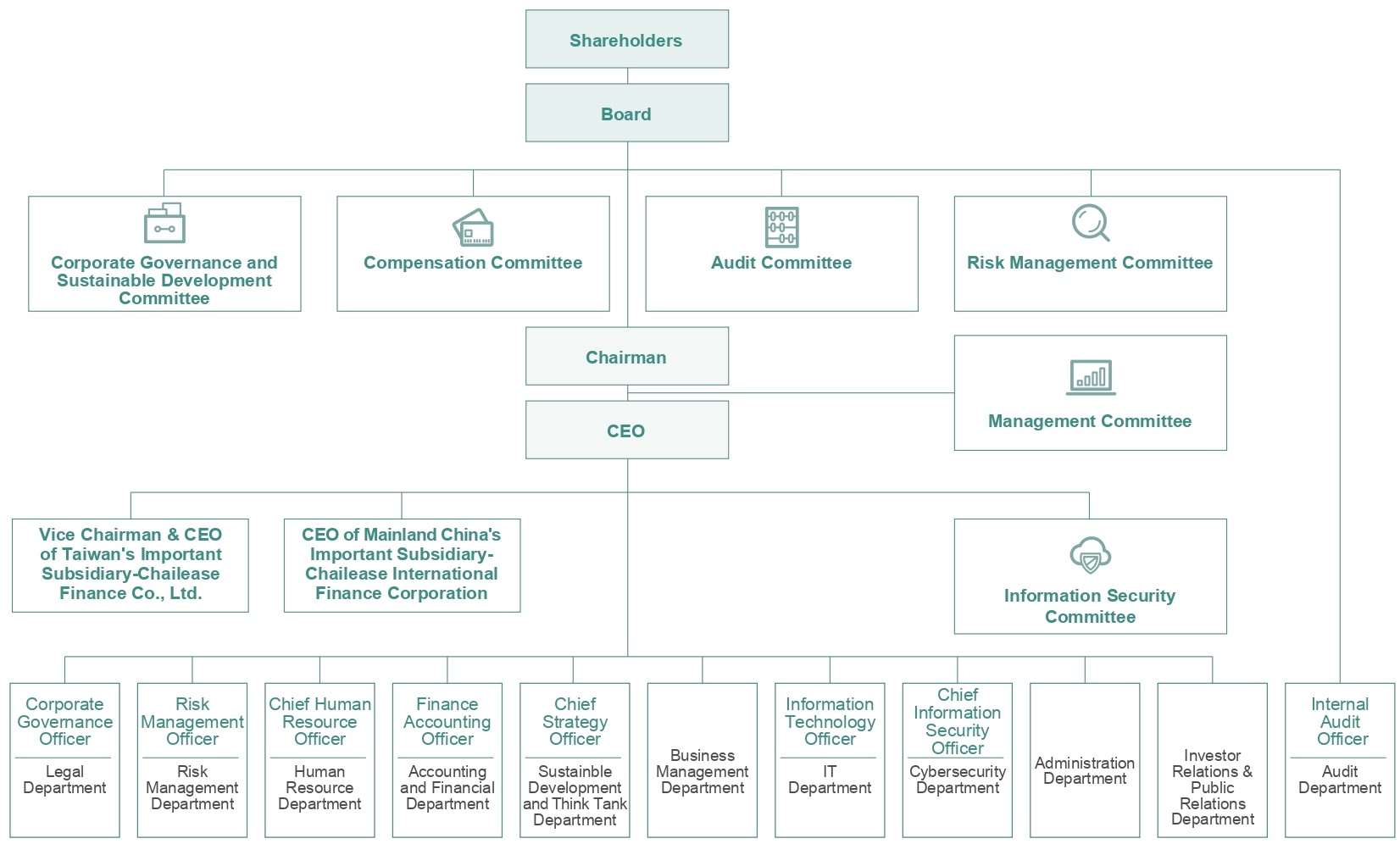

Structure and Operation of the Board

The Company sets sustainable business operation as core mission and is devoted to strengthening corporate governance mechanism, improving risk management system and fulfilling ethical management policies. To enhance the functionality and efficiency of the Board of Directors as the highest corporate governance unit, the professionalism, diversity and independence of directors are highly valued. The 5th session of the Board of Directors (including independent directors) were elected at the Annual General Meeting held on May 22, 2023. The election of directors adopts the candidate nomination system, which is nominated by shareholders with more than 1% of shares and Board of Directors, in accordance with the Company’s “Memorandum and Articles of Association” and “Rules Governing the Election of Directors”. The 5th session of the Board of Directors is composed of 5 directors and 4 independent directors. The number of independent directors was increased comparing with the previous session of the Board of Directors. As the Company being an investment holding company, it does not conduct any business of its own. Although the Company’s Chairman and the CEO are the same person, the Chairman and the CEO or other equivalent highest level manager are not the same person in the Company’s important subsidiaries: Chailease Finance Co., Ltd., FINA Finance & Trading Co., Ltd. and Chailease International Finance Co., Ltd., etc. Hence, the actual business operation is consistent to the spirit of corporate governance.

According to the Taiwan Company Act, if a director violates the law or the Company’s Articles of Incorporation in the execution of business and causes damage to the Company, he/she shall be liable to the Company for damages. This is a mandatory requirement and cannot be limited or exempted through the Company’s internal regulations or articles of incorporation. Furthermore, the Company’s internal regulations and articles of incorporation do not limit or exempt the liability of former directors for damages. In addition, amendments to the Articles of Incorporation must be approved by a "special resolution," which refers to a resolution adopted at a shareholders' meeting attended by shareholders representing at least two-thirds of the total voting rights, with the approval of a majority of the voting rights present, either in person or by proxy (if authorized).

In consideration of assisting the Board of Directors with legal compliance, strengthening corporate governance, and building a culture of compliance, the Company appointed a dedicated Corporate Governance Officer to ensure company strategies conform to all legal and regulatory requirements. Regular Board meeting should be called and chaired by the Chairman at least quarterly in compliance with “Rules and Procedures of Board of Directors Meetings”. Meeting agenda and materials are circulated to directors 7 days before the meeting to ensure directors have sufficient information to involve in discussions and decision-making, and to facilitate the board to oversee and direct the Company and the management team. The Company specifically stated in the “Regulations Governing Evaluation of the Performance of the Board of Directors” that the average of directors’ attendance rate of Board meeting and attendance rate of committees meeting on which the director serves shall reach no less than 85%. 11 Board meetings were held in 2024, and the average attendance rate of all Board members reached 99% (100% if attendance by proxy is included). The actual attendance rate of each director also exceeded 90%.

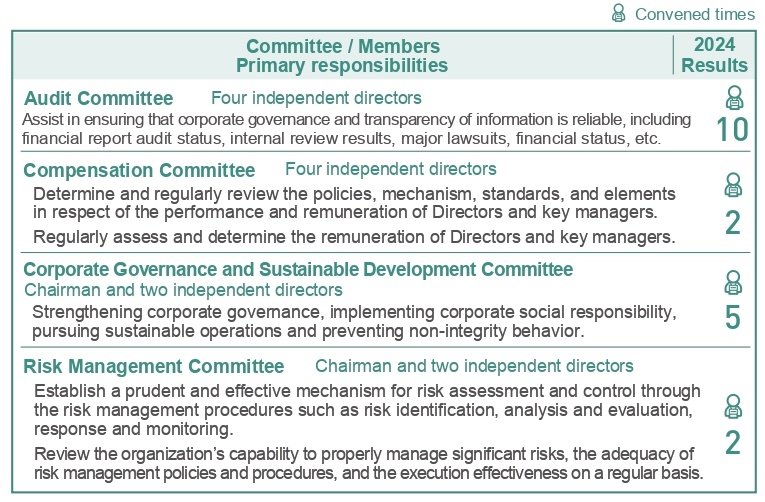

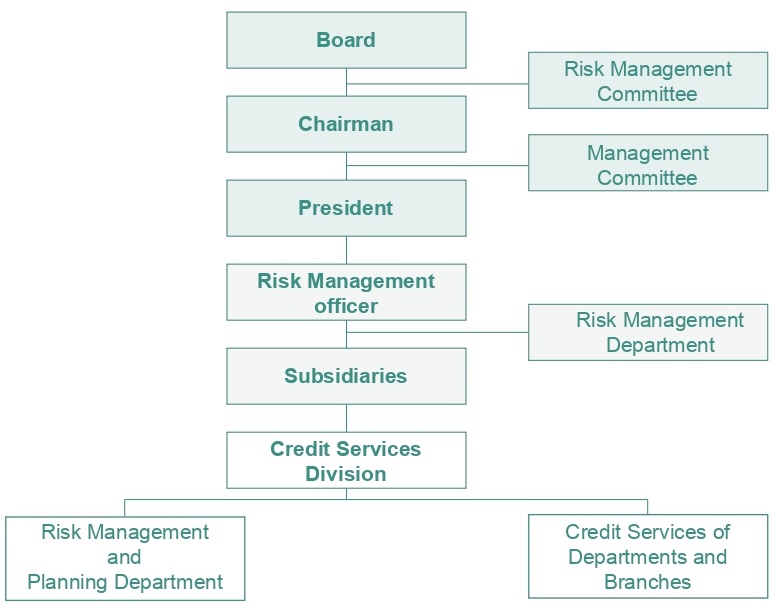

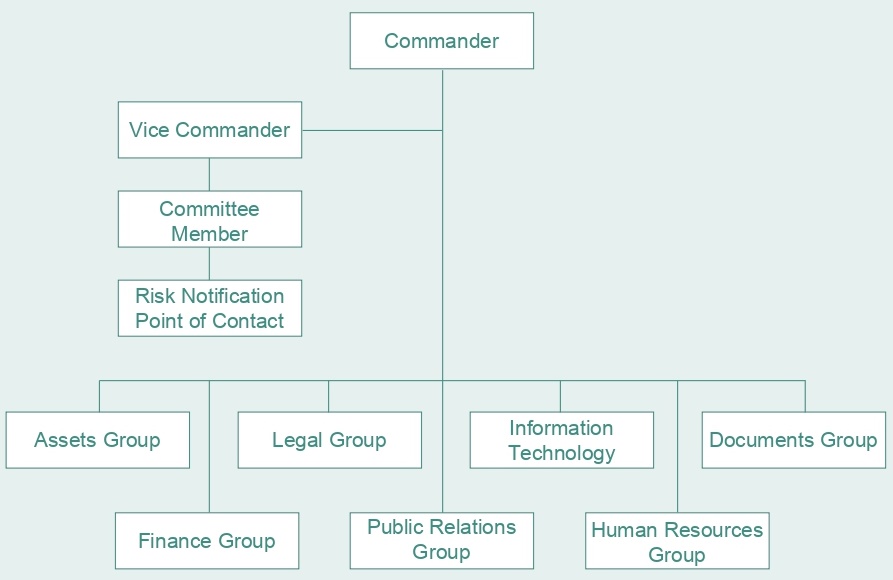

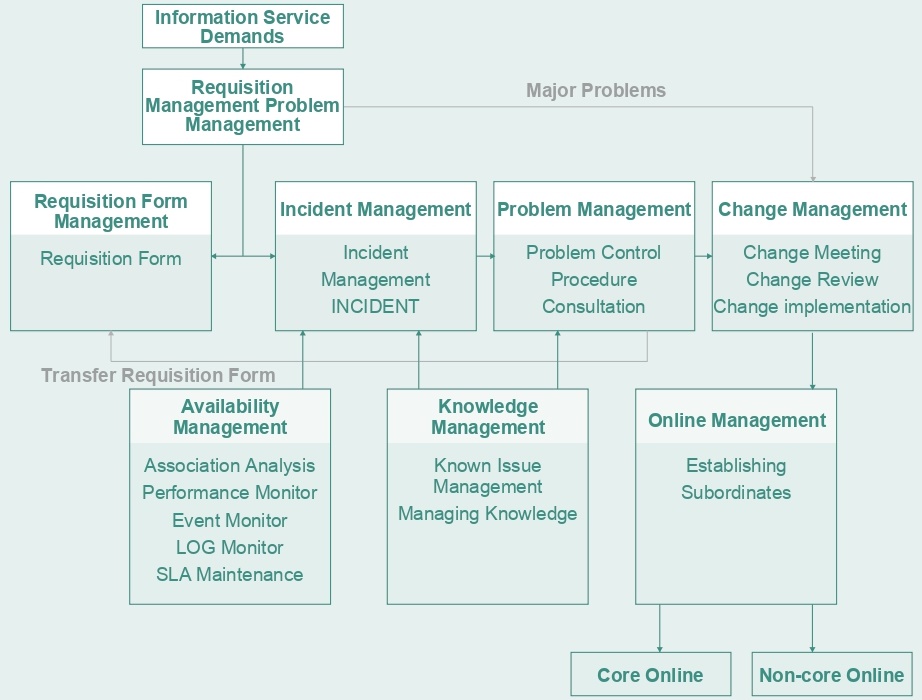

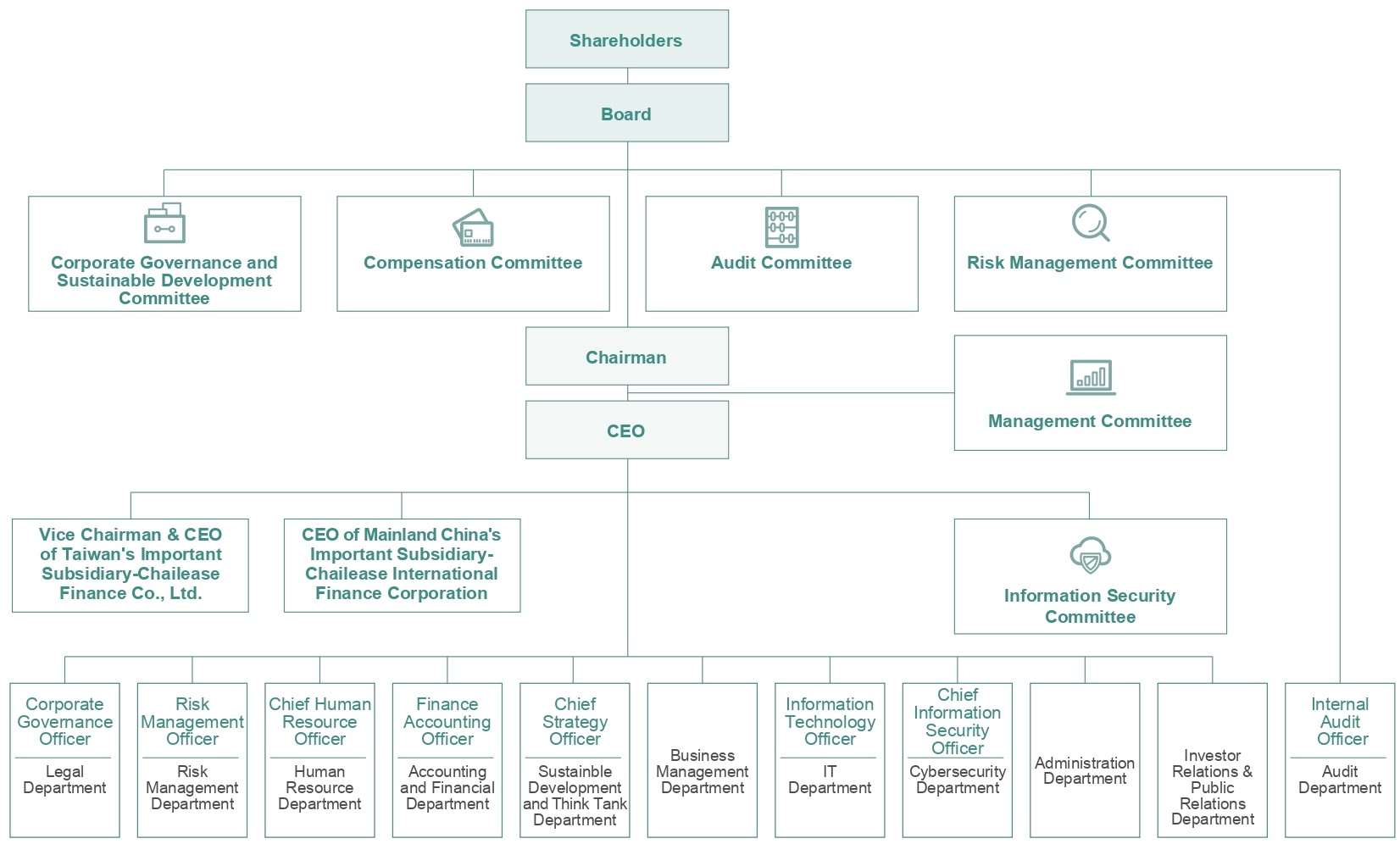

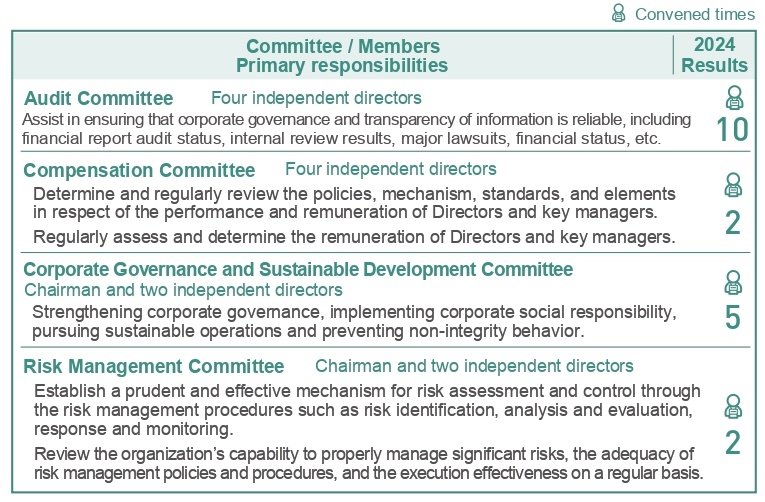

In order to effectively perform the functions of the Board of Directors and to improve the quality of decision-making by the Board of Directors, functional committees such as the Audit Committee, the Compensation Committee, and the Corporate Governance and Sustainable Development Committee have been established under the Board of Directors by the authority and function thereof. The Board of Directors further made the decision to adjust the structure and elevate the Risk Management Committee to a functional committee under the Board of Directors. The Management Committee has been established under the Chairman of the Company to be responsible for discussions on important issues related to economic, environmental, and social risks. There were no significant events included in the Board’s discussions in 2024.

The functional committees are either composed of independent directors or participated by independent directors, such that the decisions and recommendations of the committees are forward-looking, objective and thorough, and the mechanisms of independent supervision and checks and balances are effectively implemented to ensure that all resolutions and actions taken by the Board of Directors are reported and discussed by the Board of Directors. If a director has a related interest themselves or if the director represents a legal entity that is a stakeholder in a related interest, then the director should recuse themselves from the meeting. Some motions are also reported and discussed at the Shareholders' Meeting to act in the best interest of relevant stakeholders. These committees enhance the function of the Board of Directors, improve the independence of supervision and protect the rights of shareholders. The main responsibilities and status of each functional committee are as follows:

There are specific rules on handling situations in which a director’s own interests conflict with those of the Company in internal regulations. A director who is an interested party with respect to any agenda item of the Board of Directors cannot participate in discussion and voting nor hold a proxy for any other director on that agenda item and shall enter recusal during discussion and voting. Directors adhere to a high level of self-discipline and strict determination in recusing themselves from participating discussions and voting of proposals where a conflict of interest exists between the Company’s interests and the interests of a director or the legal entity that the director represents.

The Company fully disclosed the concurrent positions of the directors, the top ten shareholders and related party transactions in the 2024 Annual Report. For details, please refer to P.10~16, P.78~79 and Consolidated Financial Statements 8-(7) Related Party Transactions.

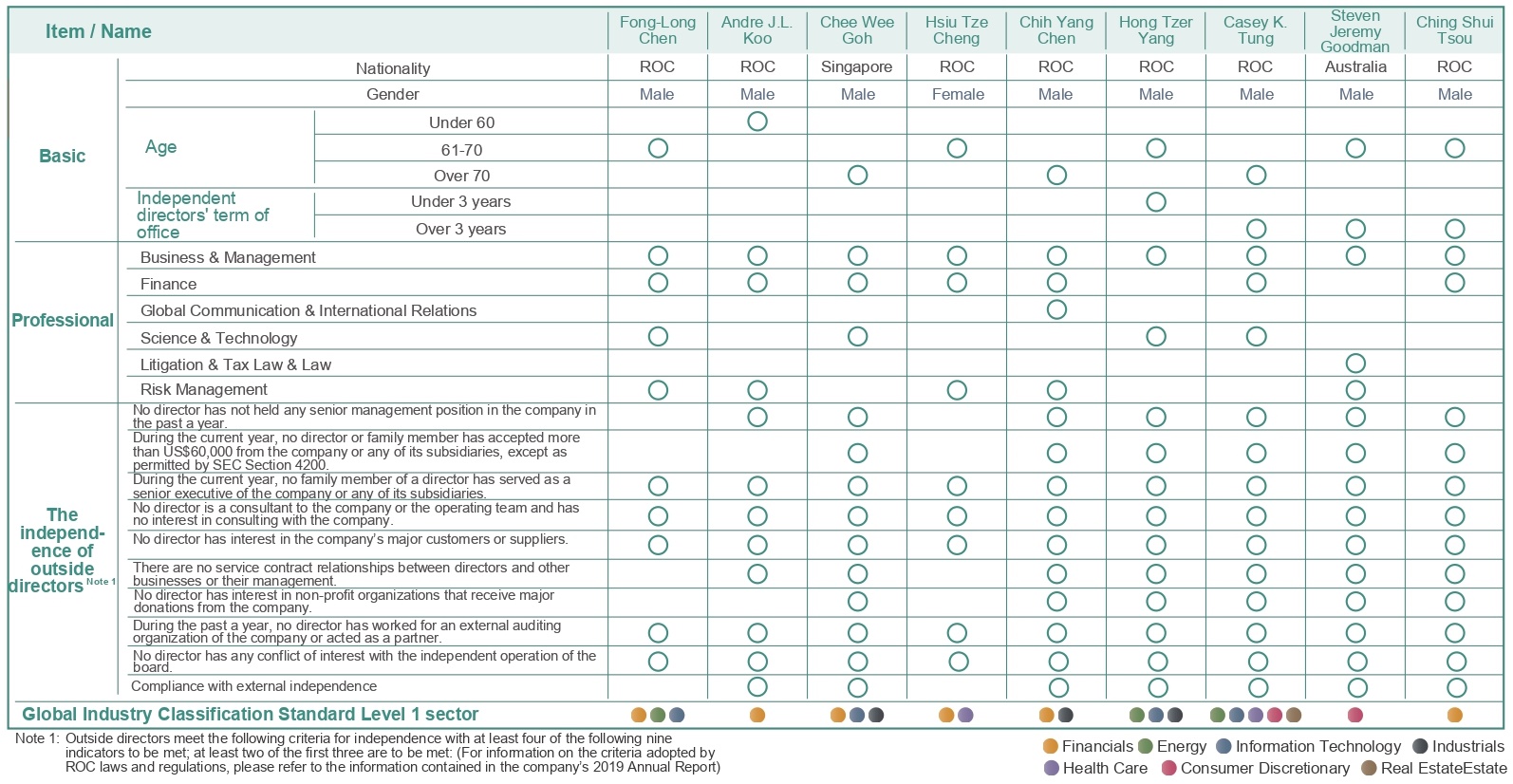

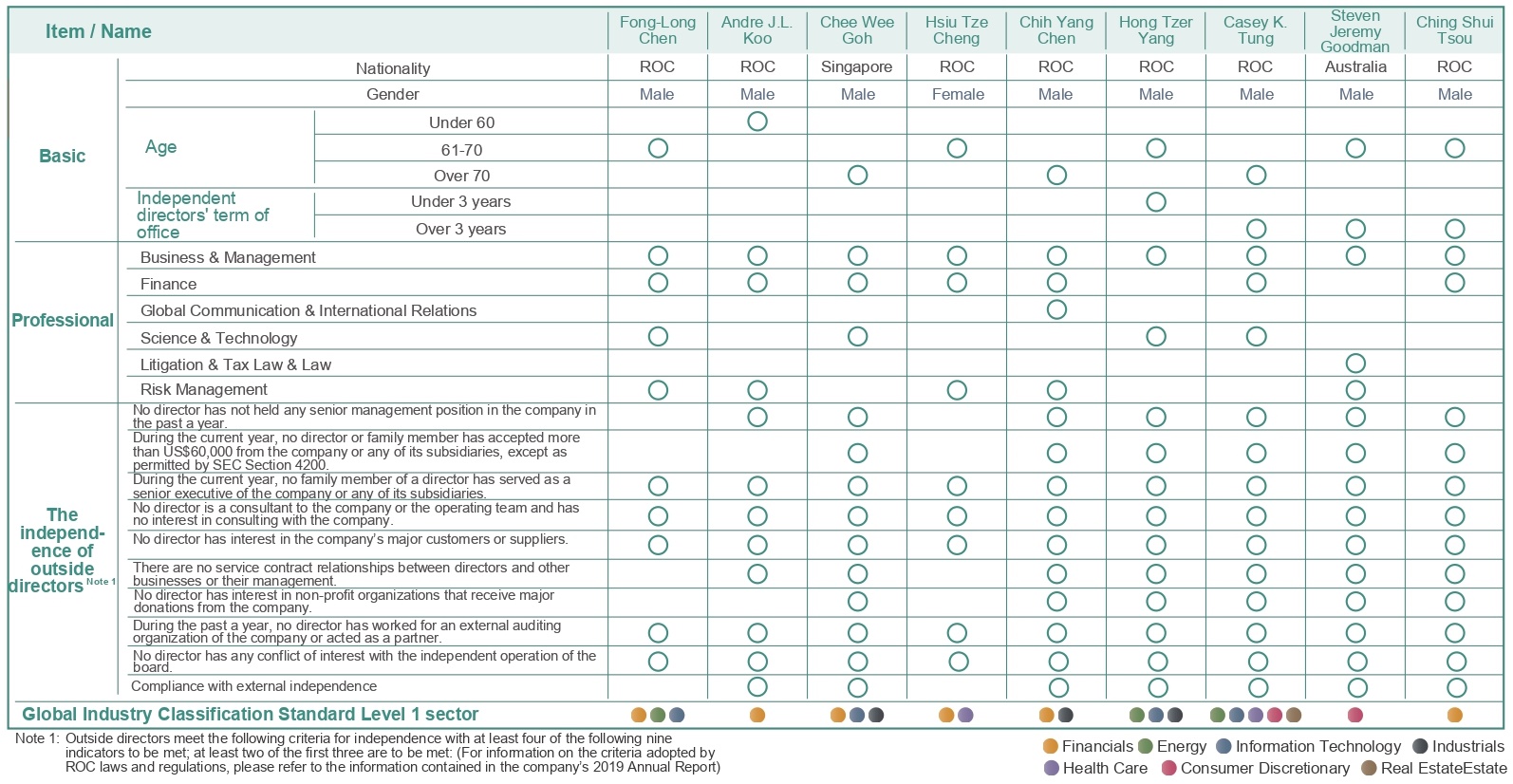

Professional Backgrounds of the Session of the Board of Directors

The composition of the Board of Directors should take into account the Company’s mid- and long-term development strategy, changing trends in external environment, major issues for sustainable management, and overall configuration and diversification. The selection guidelines include but not limited to the followings:

- Basic requirements and value: gender, age, race, nationality, and cultural background;

- Professional knowledge and skills: professional background, professional skills and industry experience.

The members of the 5th session of the Board of Directors have professional backgrounds covering finance, IT, Health Care, energy, legal and financial accounting, and have rich practical experience in corporate management, legal compliance, international taxation and corporate governance. They all have the expertise and abilities required to perform their duties. All directors are further provided with annual external training sessions that assist them to improve their professional capabilities and understanding of trending issues. In 2023, in response to promoting the global net-zero emissions target and enhancing the risk awareness, the topics of sessions included “Carbon Management Trends & Responses to Net Zero” and “Global Risk and Corporate Social Responsibility”. Every director acquired at least 6 hours of certified training, which was in line with the suggestions from external regulation. For details regarding the implementation of diversity and independence of the Board of Directors at the Company, please refer to P.21~24 of the 2024 Annual Report of the Company. The Board of Directors includes stakeholder representatives, comprising both shareholders and employees.

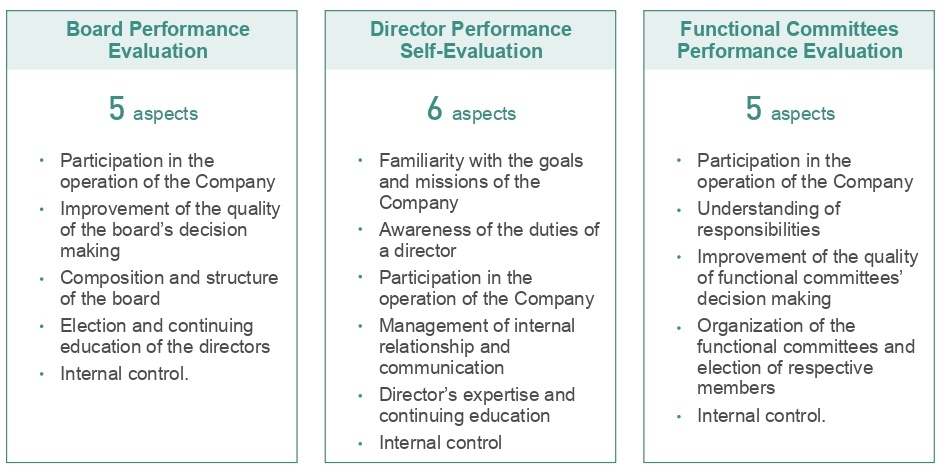

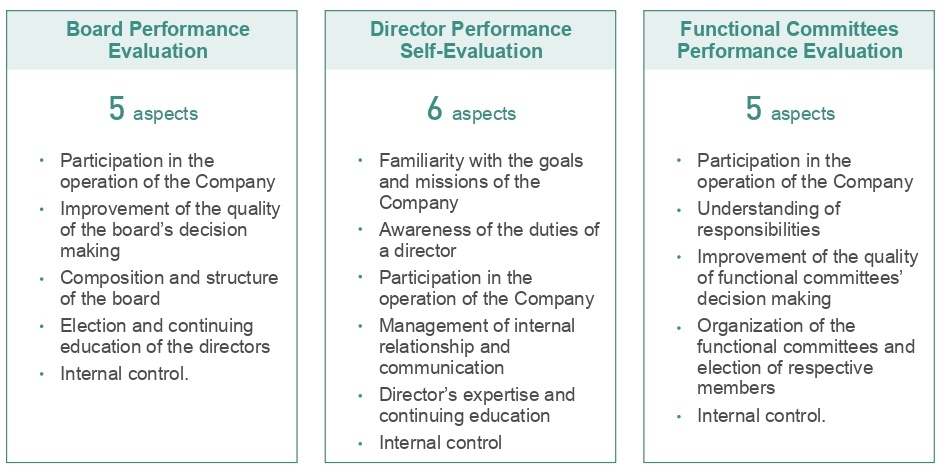

Evaluation of the Performance of the Board of Directors

To fulfill corporate governance and enhance the effectiveness of the Board of Directors, the Company has established “Regulations Governing Evaluation of the Performance of the Board of Directors” pursuant to “Corporate Governance Best-Practice Principles”. The Company regularly conducts performance evaluations of the Board of Directors and functional committees in November annually for the evaluation period from November 1 of the preceding year to the end of October of the current year. The performance evaluation scope covers the performance of the Board as a whole, functional committees and individual directors. The performance evaluation was assessed based on the questionnaire on a scale of 1 to 5 (5 is the full score) with the assessment items as below:

If 90% of the measurement indexes reach 4 points or more, the internal performance evaluation result in a grade of “Exceed the Standard”; if more than 80% but less than 90% of the measurement indexes reach 4 points or more, the result shall be in a grade of “Meet the Standard”; if less than 80% of the measurement indexes reach 4 points or more, the result shall be in a grade of “Moderately Unsatisfactory”. Please refer to the Company’s website for the board performance evaluation report of 2024 (https://www.chaileaseholding.com/en/CorporateGovernance/Directors).

Every three years, the Company commissions a third party to perform an external performance evaluation. In 2023, the Taiwan Corporate Governance Association (hereafter “TCGA”) was engaged to conduct board performance evaluation. The TCGA and execution experts have no business relationship with the Company and are independent. The evaluation procedures not only contained the review of written descriptions for assessment indicators and supporting documents, but also face to face meetings between the TCGA and directors, each functional committee convener, and top managements. The TCGA examined the operation of the board of directors and each functional committee from 8 aspects, including the composition, direction, authorization, supervision, and communication of the board, internal control and risk management, self-discipline of the board, board meetings and supporting system, based on its wide experience of corporate governance assessment. The Company obtained objective comments and suggestions from the Board Performance Evaluation Report issued by the TCGA on December 4, 2023. The Company reported TCGA’s suggestions related to above matters and measures to be taken to the Board on March 23, 2023 and amended the “Regulations Governing Evaluation of the Performance of the Board of Directors” at the same meeting to enhance the operational efficiency of the Board.

In order to continuously strengthen corporate governance, the Company complies with external regulations while draws lessons from indicators of international assessments. The Company revised “Operational Procedure for Preparation and Validation of the Sustainability Report”, “Regulations Governing Evaluation of the Performance of the Board of Directors”, “Audit Committee Charter”, “Corporate Sustainable Development Best Practice Principles” and “Internal Control Systems and Internal Audit Systems of the Company” in 2024.

The Remuneration policy

(I) Remuneration policies, standards, and packages:

1. Remuneration for directors shall observe Article 94 of Chailease Holding’s Articles of Association. The Board of Directors (BoD) shall consider suggestions from the Compensation Committee and industry standards to determine remuneration. The remuneration of the Company’s directors consists of a fixed monthly payment, transportation and communication allowances, meeting attendance fees, and directors’ compensation. Article 118 of our Articles of Association also rules that the BoD may distribute profit-sharing compensation to current directors in years when the company is profitable. Profit-sharing compensation to directors shall not exceed 0.1% of earnings before taxes for that accounting period (year). In compliance with "Rules for Performance Evaluation of Board of Directors," Chailease Holding conducts at least one internal performance evaluation annually and one external performance evaluation, by external independent agencies or experts/ scholar teams, every three years. Chailease Holding provide reasonable remuneration based on the company's performance, industry standards, and the result of performance evaluation of directors, which include but is not limited to individual contribution to company performance, attendance, and participation. Performance evaluations and remuneration both require approval from the Compensation Committee and BoD.

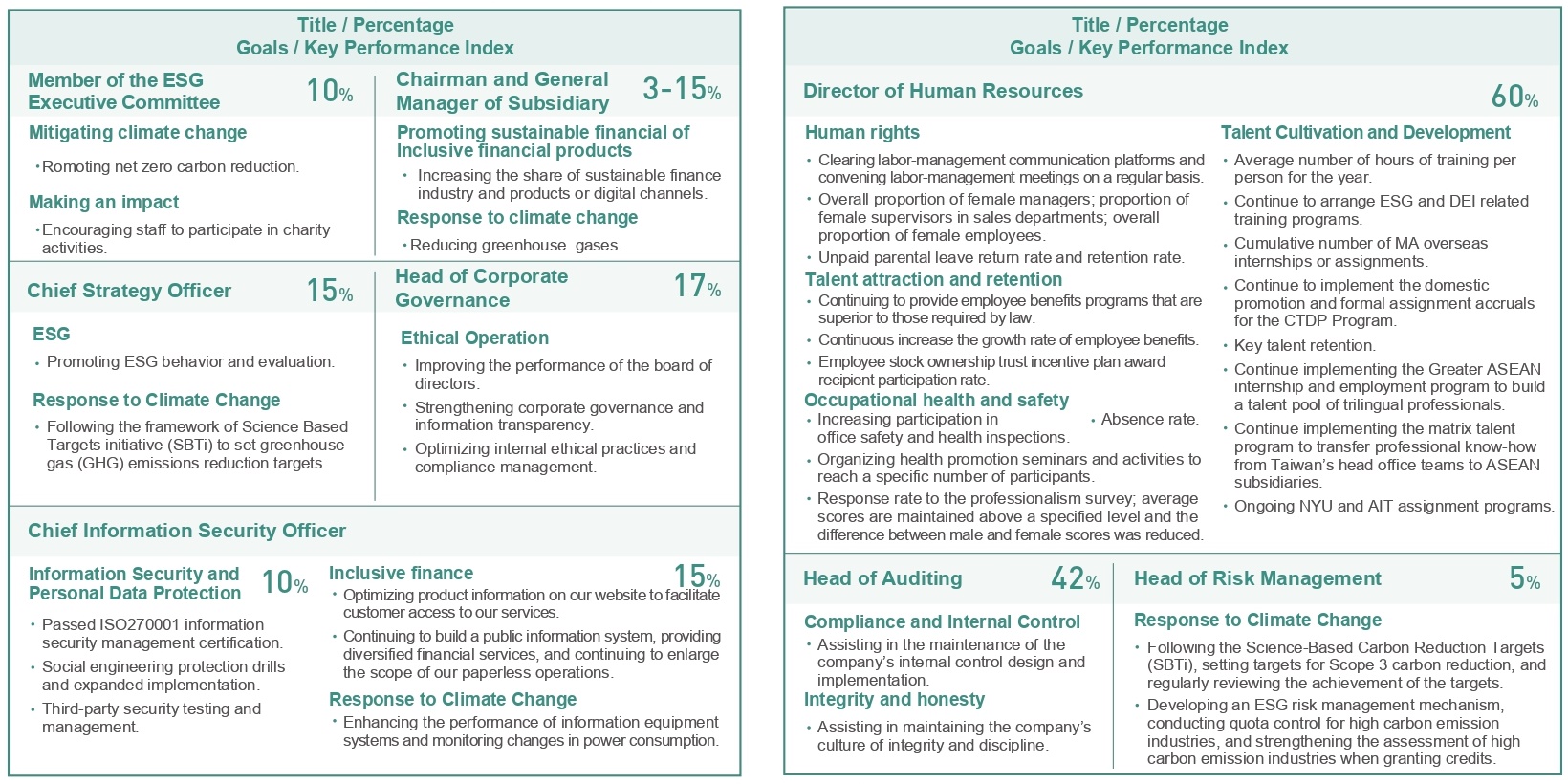

2. Remuneration for managerial officers shall observe Article 94 of our Articles of Association. The BoD shall consider suggestions from the Compensation Committee and industry standards to determine remuneration. Article 118 of our Articles of Association also rules that the BoD may distribute profit-sharing compensation to current employees in years when the company is profitable. Profit-sharing compensation to employees shall account for between 0.01%~1% of earnings before taxes for that accounting period (year). Chailease Holding determines profit-sharing compensation for managerial offices based on performance evaluations in compliance with "Rules for Objective Management" and "Rules for Performance Review." KPIs for managerial officers fall under the two following categories. The company will then determine a profit-sharing compensation based on their managerial performance and review the remuneration scheme when necessary to reflect company performance and related regulations:

(1) Financial KPIs:

KPIs: Sales fulfillment, earnings before taxes (EBT) fulfillment, return on equity (ROE), delinquent ratio, remaining principal balance, net profit per personnel expense, and net profit ratio per capita. In addition to evaluating KPI fulfillment toward annual targets, the company also considers KPI growth from the same period last year.

(2) Non-financial KPIs:

In addition to financial KPIs, the company also evaluates non-financial areas such as strategic objectives, risks to sustainable operations, corporate governance and material topics. The managerial officers' non-financial indicators also contain 10% of the sustainable development goals, including but not limited to the increase in the scale of solar power plant assets (including the simultaneous increase in the number of solar power plants and total power generation capacity), energy conservation, expand carbon inventory, and improvement of occupational safety and health prevention plans, etc. In addition, 10% of the Chailease common goals include but are not limited to energy conservation and departmental public service hours.

3. Remuneration packages at Chailease Holding include monetary compensation, stock options, stock bonus, pension plan, offboarding compensation, other allowances, and other measures providing actual compensation. The packages for directors and managerial officers shall be determined in compliance with the organizational rules of the Compensation Committee and shall remain consistent with the scope published in annual reports.

(II) Procedures for determining remuneration:

1. Directors are evaluated based on the "Rules for Performance Evaluation of Board of Directors" and managerial officers and employees are evaluated based on the "Rules for Objective Management" and "Rules for Performance Review." Results from the evaluations serve as the basis for regular evaluations of remuneration to directors and managerial officers.

2. The business strategies, HR policies, and payment capacity determine remuneration policies at Chailease Holding. The Compensation Committee and BoD also annually evaluate and review performance evaluations and remuneration for directors and managerial officers. In addition to individual KPI fulfillment and contribution to company performance, the company also considers overall business performance and future risks and development trends in the industry. In addition, the company monitors actual company operations and related regulations to review the remuneration scheme when necessary to thereby fulfill sustainable operations and risk control. The actual remuneration paid to directors and managerial officers in 2024 was deliberated by the Compensation Committee and then submitted to the BoD for deliberation and approval.

(III) Linkage to operating performance and future risk exposure:

1. To enhance the efficiency of the BoD and units under managerial officers, remuneration standards and schemes are evaluated primarily in consideration of the company's overall operations, while remuneration is determined by KPI fulfillment and contribution. In addition, the company refers to industry standards by regularly commissioning management consulting firms to survey compensation levels in the finance sector and using survey results to evaluate our own compensation standards and provide competitive compensation, ensuring that compensation to managerial officers is competitive to retain outstanding managerial officers.

2. To manage and regulate potential risks within the scope of their job functions and duties, the KPIs for managerial officers are connected to risk control. The results of performance evaluations are then considered in tandem with related HR and compensation policies. Material decisions from managerial officers at Chailease Holding shall be derived from careful consideration of various risk factors. The performance of related decisions will reflect in the company's profits and affect the compensation of managerial officers and their KPIs on risk control.

3. Long-term incentive plans for senior executives: Chailease Holding established the "Officers Stock Ownership Trust Plan", in consideration of the plausibility of association with future risk exposure, to incentivize managerial officers to meet and exceed company targets, generate profits, and enhance business performance. The "Officers Stock Ownership Trust Plan"(note 1) is mapped out with consideration to deferred reward, long-term reward, and Stock Ownership Requirement of Officers.

Bonuses to the CEO and other senior executives are primarily derived from the company's business performance, ESG, total shareholder return (TSR), and future risk factors. Deferred reward are capped at 20% of the year-end bonus from the previous year, which will be deposited into a dedicated Officers Stock Ownership Trust Plan account for payment deferral of at least 1.5 year. Distribution of deferred bonuses will be based on TSR fulfillment in comparison to the year's Finance and Insurance Sub-index compiled by the Taiwan Stock Exchange (TWSE), connecting bonuses for senior executives with long-term company’s performance and shareholder interests. In the event of material risk events impacting the company's goodwill or similar situations, the company may deduct or withhold bonuses according to the "Salary Recovery Policy" depending on circumstances (No retroactive period).

The ratio of the annual total compensation of the Company’s highest-paid individual to the median of the annual total compensation of all other employees (excluding the highest-paid individual) ranges from 42.30 to 84.60 (Note 2). The ratio of the percentage increase in the annual total compensation of the Company’s highest-paid individual to the median percentage increase in the annual total compensation of all other employees (excluding the highest-paid individual) showed no difference between the two years (Note 3).

4. Future risks to company operations mainly stem from losses from bad debt, a factor of asset quality. Chailease Holding has established a Risk Management Department to handle and oversee assessments of asset quality for finance-related business units. The company will adjust the percentage of bad debt reserves for regular cases according to asset quality. When losses from bad debt increase, the individual performance and, therefore, bonuses of directors, presidents, and vice presidents will decrease accordingly.

Note:

- The "Officers Stock Ownership Trust Plan" is applicable to the same targets as the "Stock Ownership Guidelines".

- The annual total compensation of the highest individual of the Company’s employee compensation (President) on the annual report of the shareholders’ meeting of the Company’s honorarium range (NT$50~100 million)/median salary of full-time employees who are not in supervisory positions.

- There was no difference in the annual total remuneration of the highest paid individual of the Company’s staff (President) between the two years in terms of the remuneration banding in the annual report of the shareholders’ meeting (NT$50~100 million).

- The average shareholding value of senior executives other than the President in 2024 was 21.5 times that of their total annual base salary.

The pension plan offered at Chailease Holding is also better than regulatory requirements (also applicable to regular employees) to encourage managerial officers to contribute and deliver their best efforts to Chailease Holding.

ESG Performance and Reward System of Senior Managers

We promote the linkage of ESG with the work objectives of senior managers in each company, and through the performance management mechanism, we have set up a reward system linking the ESG-related work performance of managers and employees in the Management by Objectives (MBO) program to achieve effective ESG promotion. Of these, objectives related to climate-related risks and opportunities (such as promoting net-zero carbon reduction and sustainable financial services) have accounted for more than 7% of the MBO ratio of the ESG Executive Committee’s senior management every year since 2024 as a means to implement the Company’s strategies and actions in response to climate issues.

In order to truly promote environmental sustainability and implement the development of carbon reduction and energy creation, Chailease Holding has been actively investing in green energy since 2010 and established Chailease Energy Integration Co., Ltd. in 2015 to provide a full range of green energy solutions, including equipment sales and financing, power plant planning and development, new energy investment, operation and maintenance. Our employees have further set performance goals related to climate change, integrating the concept of environmental friendliness into the mission of mutual prosperity and goodwill for individual employees and even management, and providing bonuses to recognize achievements in meeting energy-saving or energy-creation goals. In addition, we select exemplary employees of the year each year, including those who have demonstrated good performance on climate change issues. In order to achieve the solar installation capacity goal, all Chailease Energy Integration Co., Ltd. employees, including supervisors, receive honorary leave (extra days off), public recognition, bonuses for achieving KPIs (Key Performance Indicators), and prizes.