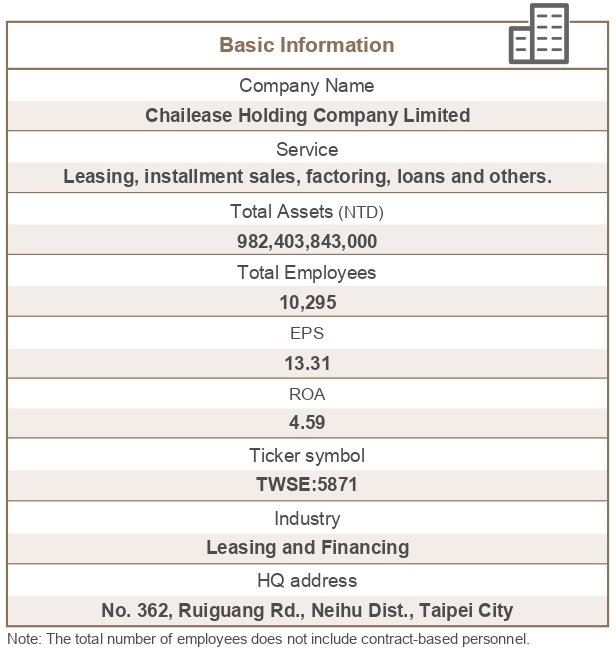

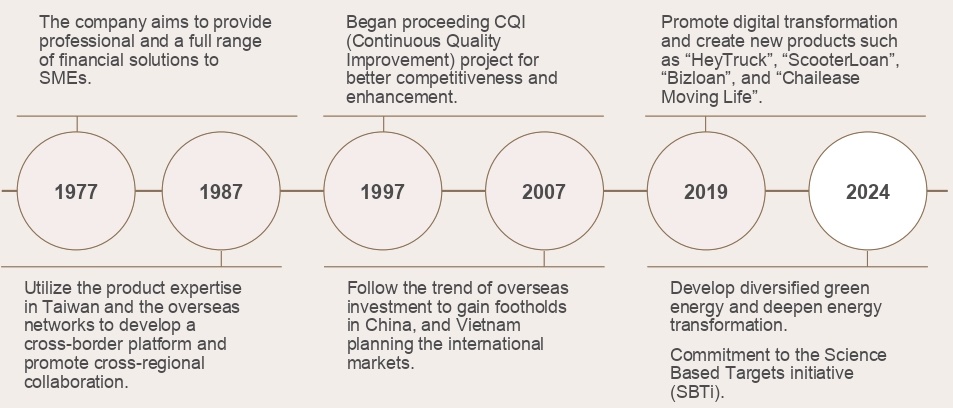

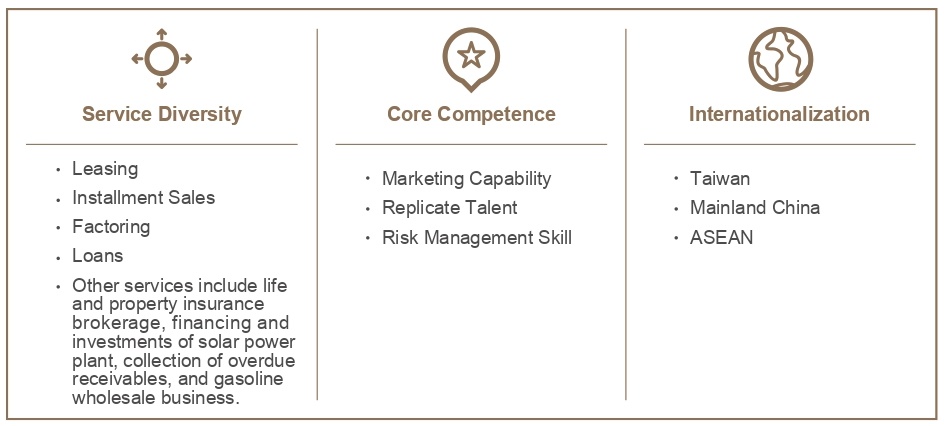

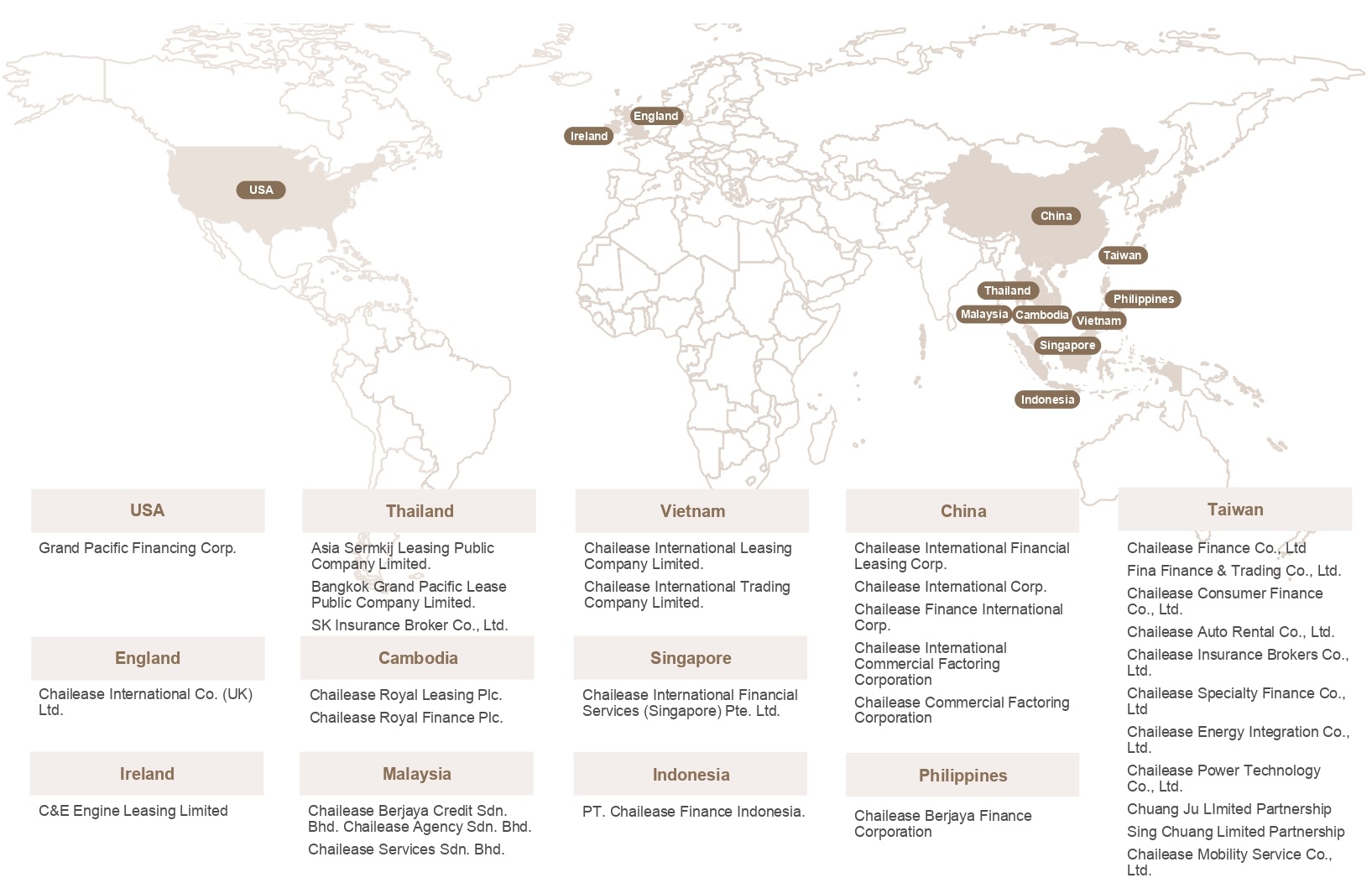

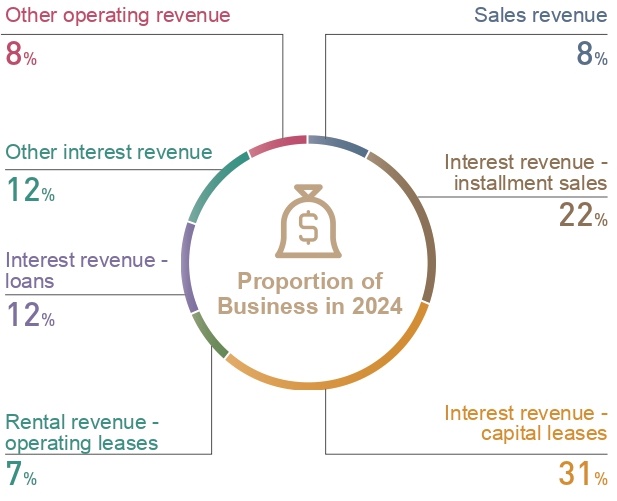

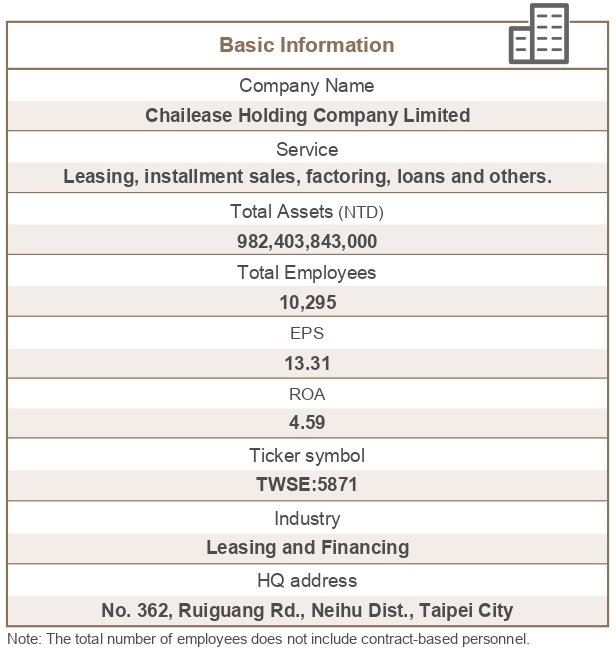

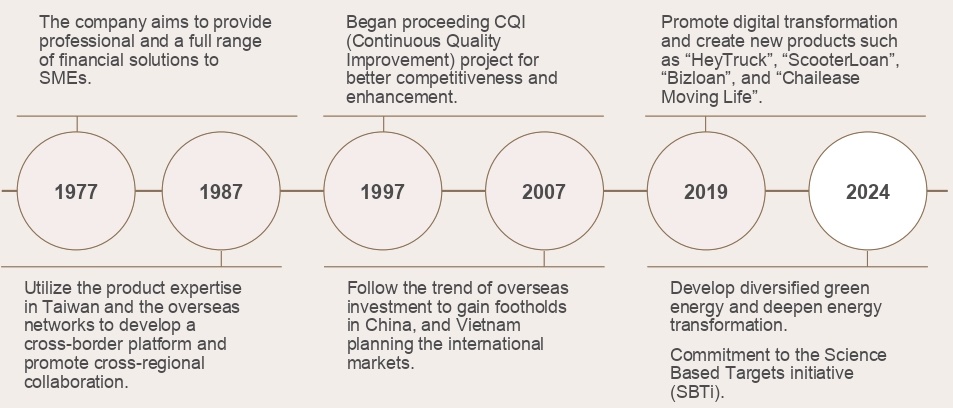

In 1977, our first operating entity, China Leasing Company Limited, commenced business in Taiwan. In addition to traditional leasing, installment sales and factoring services, the company successfully developed new financial products to cope with SMEs' funding needs for their diverse business development. Including heavy vehicle and automobile financing, construction equipment financing, fishery inventory financing, micro-enterprises financing, non-performing assets auction, real estate financing, office equipment leasing, medical equipment financing, car rentals, ESCO financing and services, solar power plant financing and investment, inventory financing (including cross-border), aircraft and ship financing, gasoline wholesale business, and insurance brokerage. We currently have operations in Taiwan, PRC, Thailand, Vietnam, Malaysia, Cambodia, Philippines and Indonesia. There are no significant differences between the 2024 supply chain and that of 2023.

Chailease Holding continued to rely on product and service innovation to maintain its lead position in Taiwan’s financial leasing market with earnings hitting new records each year. Our management strategy centers on the unique SMEs finance model as core competence. The company has been devoted to the development of the SMEs credit business, established the risk assessment mechanism for SMEs, and granted several business method patents on above fields.

Global Locations

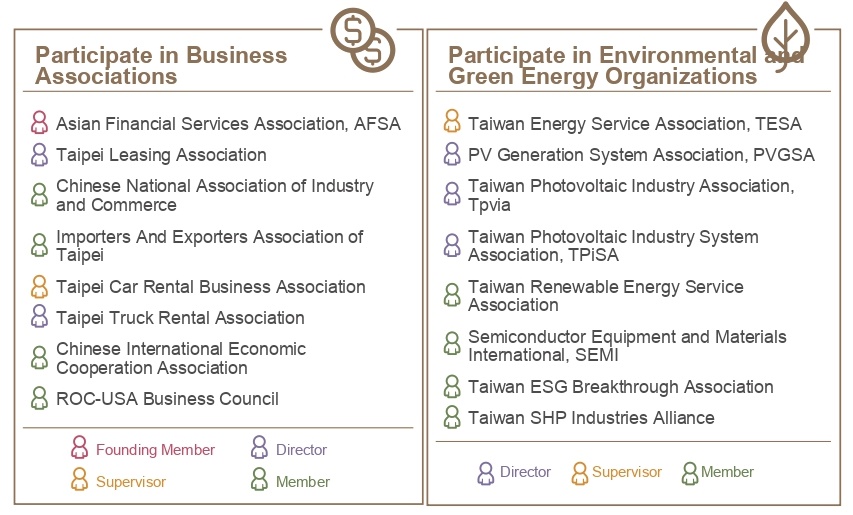

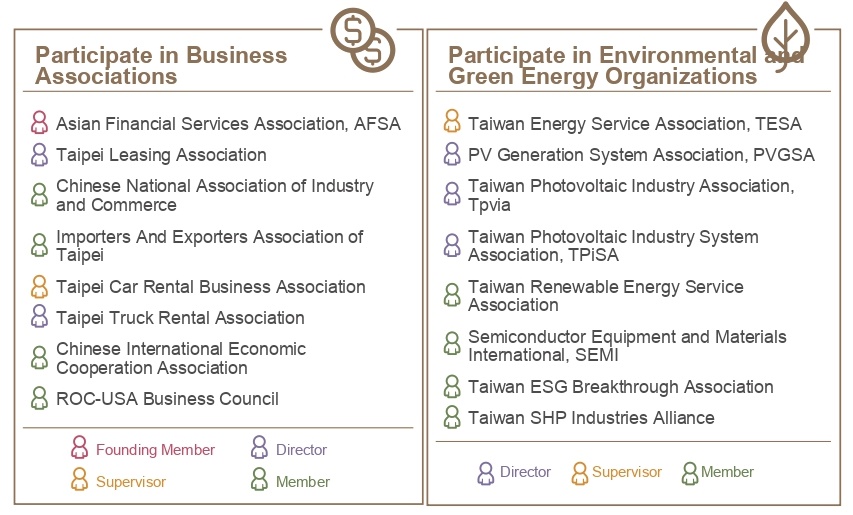

Club Organization and External Exchanges

The company has taken the lead in joining international organizations such as the Asian Financial Service Association (AFSA). Since its establishment to provide customers with international quality, professional service and the company continuously absorbs the latest knowledge and technology from financial related business to maintain our professional advantage among competitors. Meanwhile, we founded the Taipei Leasing Association to provide a platform for members to exchange ideas, knowledge, experience and information, all of which will be of mutual benefits to the parties concerned.

Other participating business associations include: Chinese National Association of Industry and Commerce, Importers and Exporters Association of Taipei, Taipei Car Rental Business Association and Taipei Truck Rental Association. Besides, our company has also joined international economic and trade organizations such as Chinese International Economic Cooperation Association and “ROC-USA Business Council to assist the government in expanding economic and trade diplomacy and integrating it with international standards.

Organizations Related to Environmental Protection and Green Energy

In coordination with the policy of the Bureau of Energy of the Ministry of Economic Affairs and Chailease's own strategy for long-term development of energy services, Chailease has actively participated in energy-related organizations such as TESA, TAESCO, PVGSA and TPVIA, and through exchanges of information with members about case studies. Chailease has raised the quality of its energy technology services and opened up new business opportunities in the energy market, in the hopes of conserving energy and reducing carbon emission, as well as making a contribution in the field of energy management.

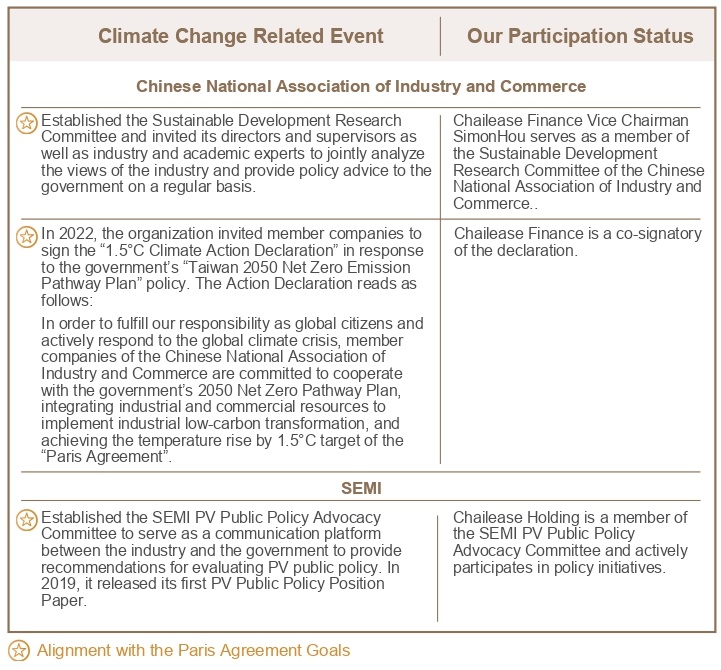

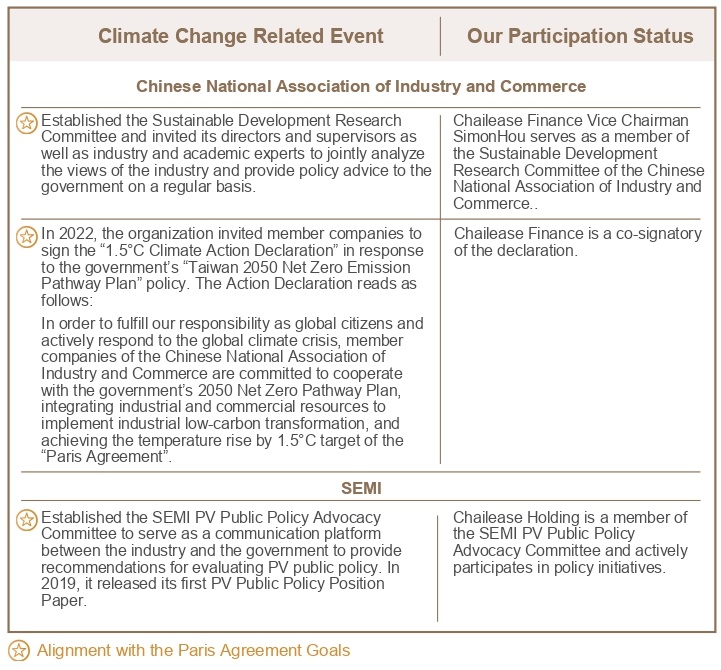

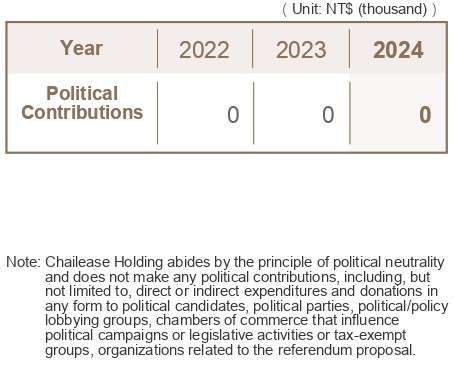

Lobbying and Trade Association–Climate Alignment

Chailease Holding issued a "Climate Policy Declaration". In alignment with the Paris Agreement’s goal of limiting temperature rise to 1.5°C, Chailease Holding will use our influence to actively implement various environmental management and energy conservation policies through lobbying or participation in trade association. Furthermore, we have a management system in place to align our policies and regulations related to sustainable finance with the goals of the Paris Agreement. If it is found that policies set by the government or trade association are not in line with the objectives of the Paris Agreement, the company will clarify the problem in terms of practical difficulties we face and will actively negotiate and take action or consider canceling lobbying or terminating membership.

Participate in or support organizations and activities related to climate change