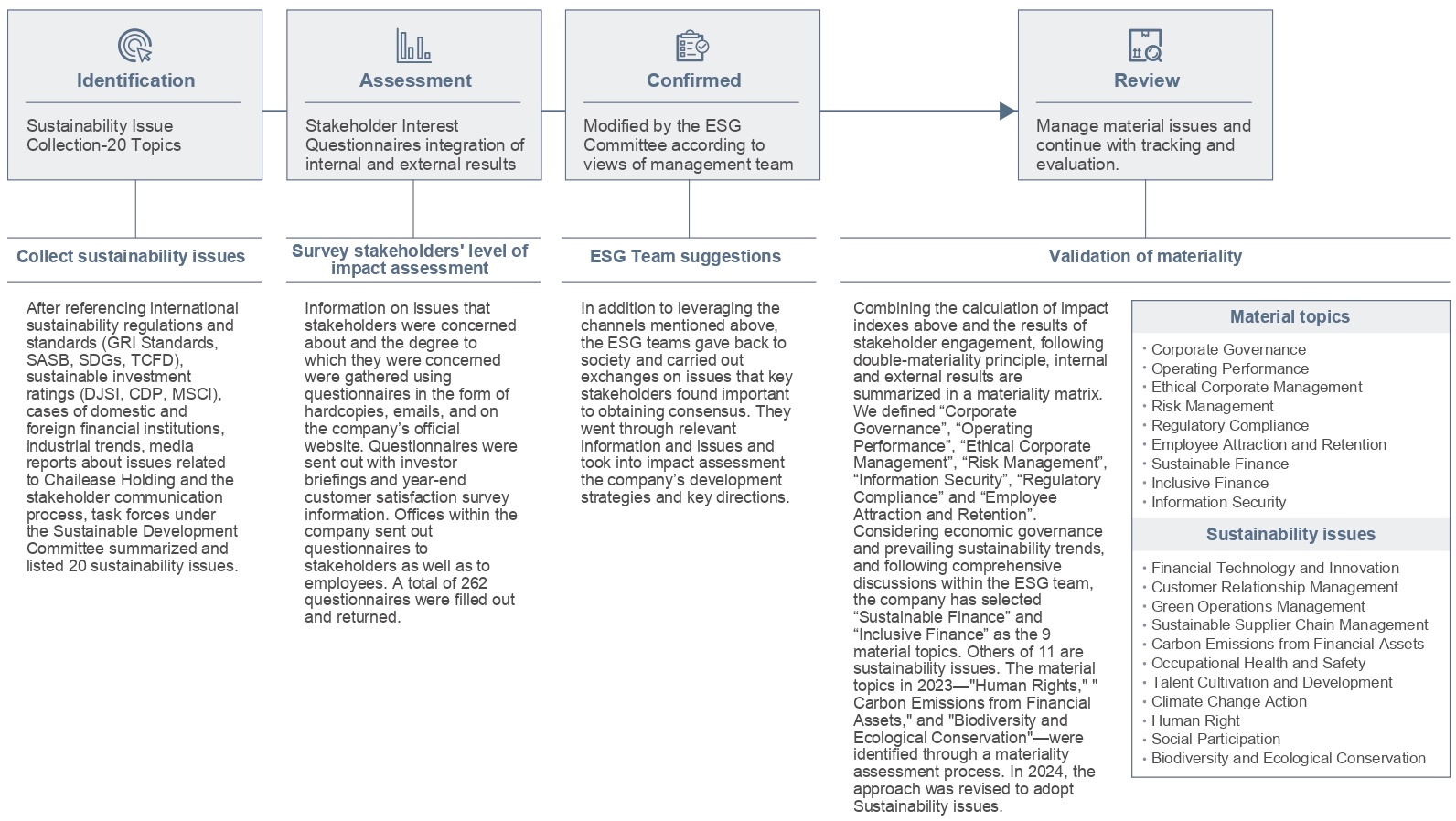

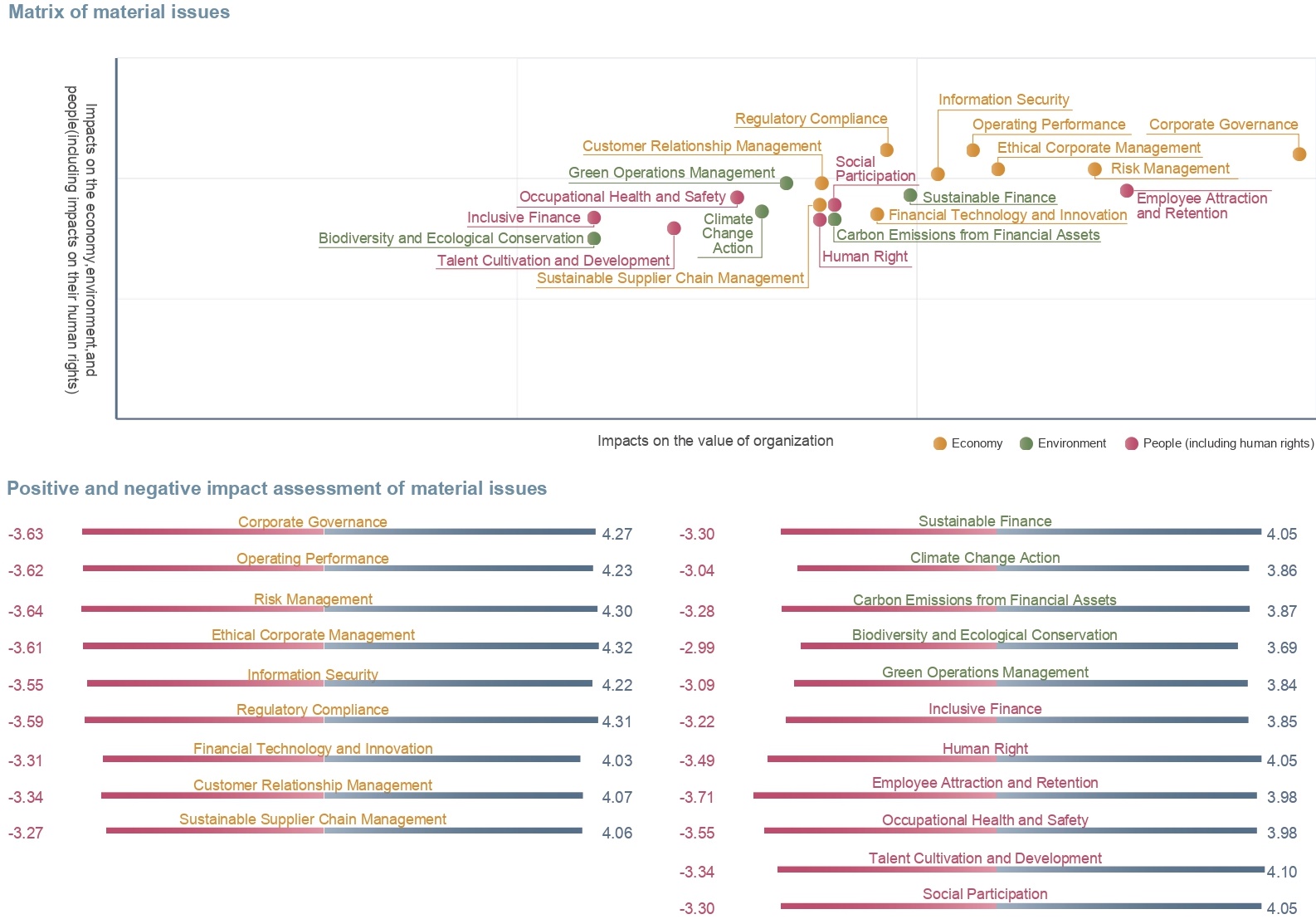

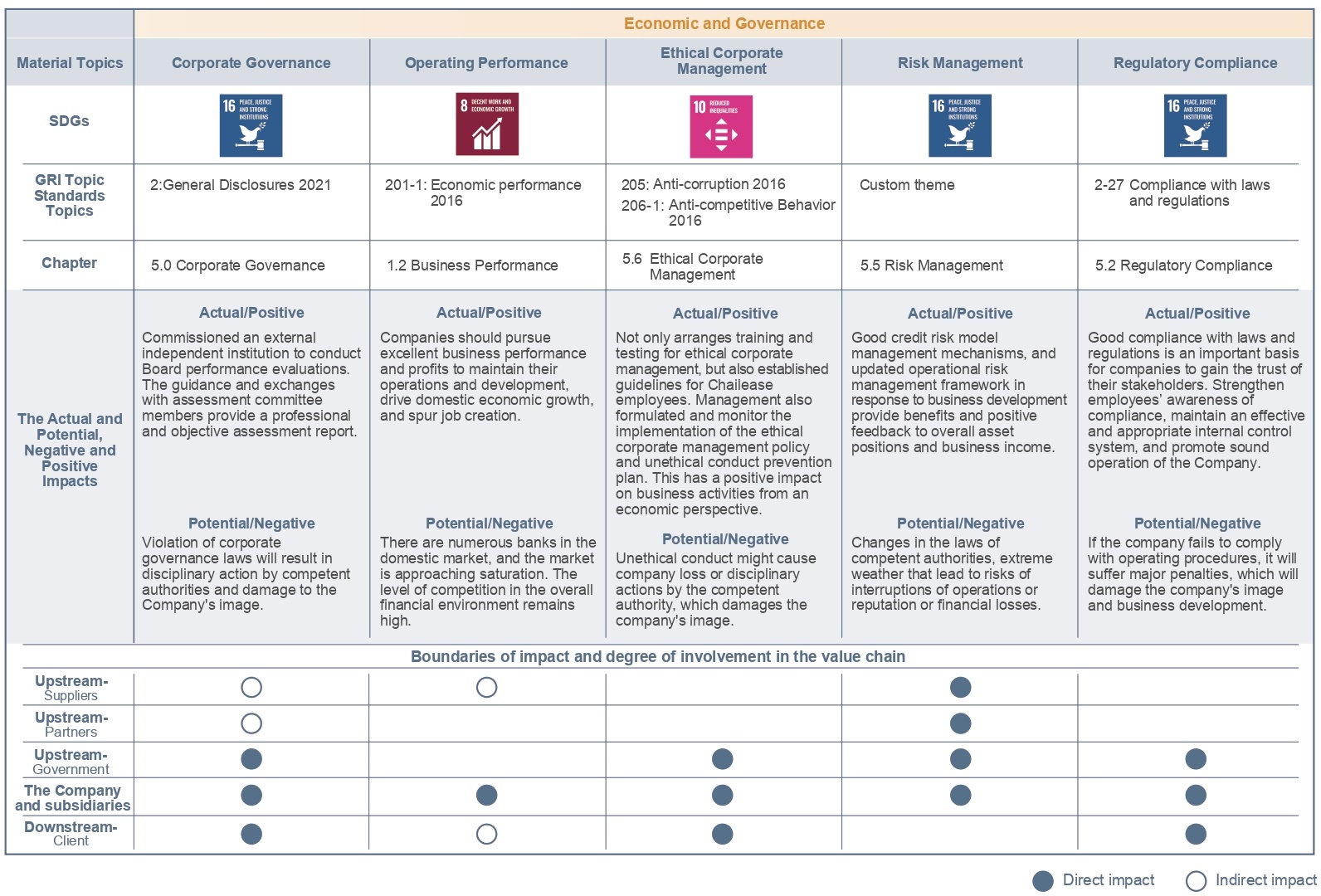

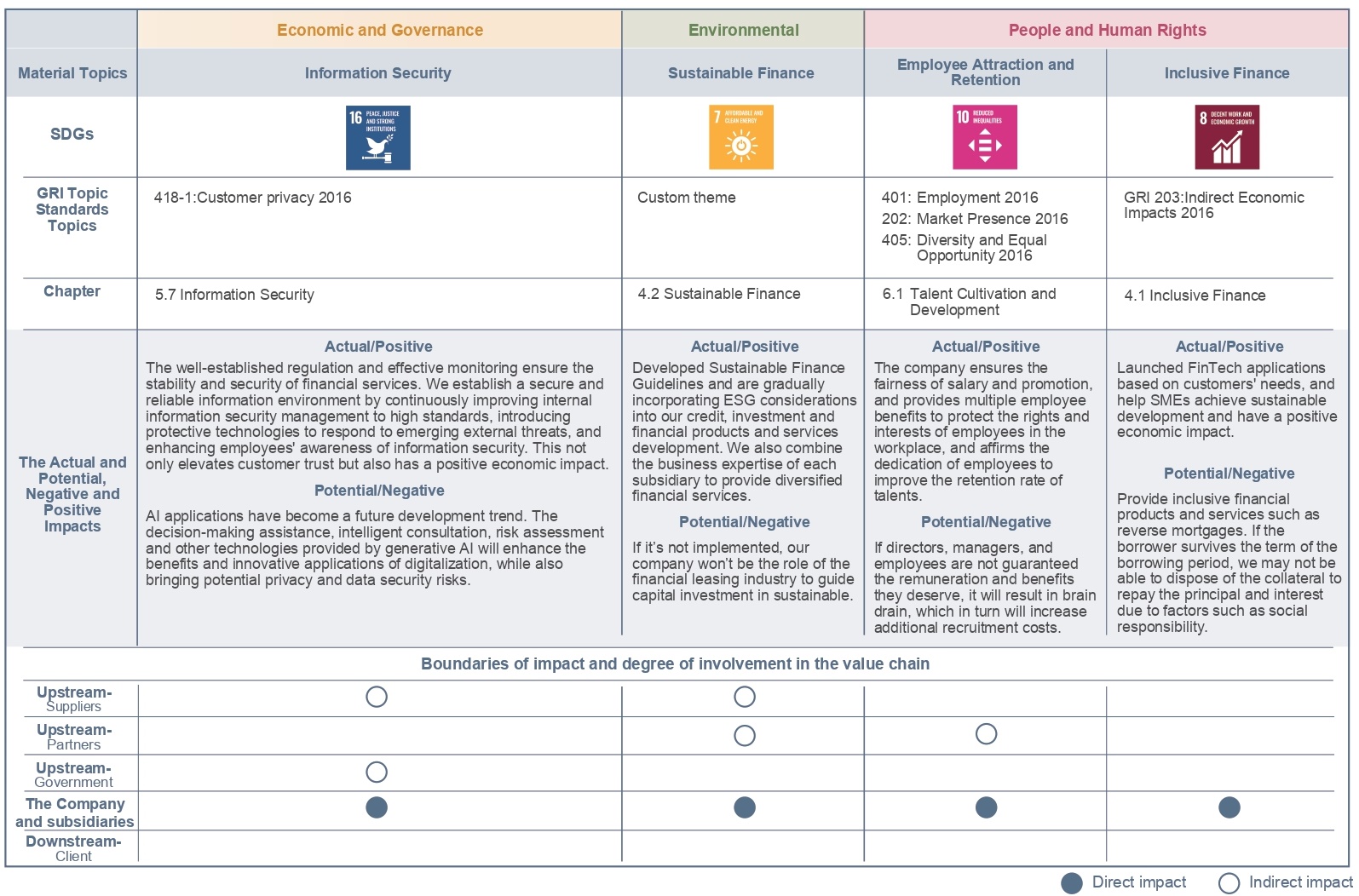

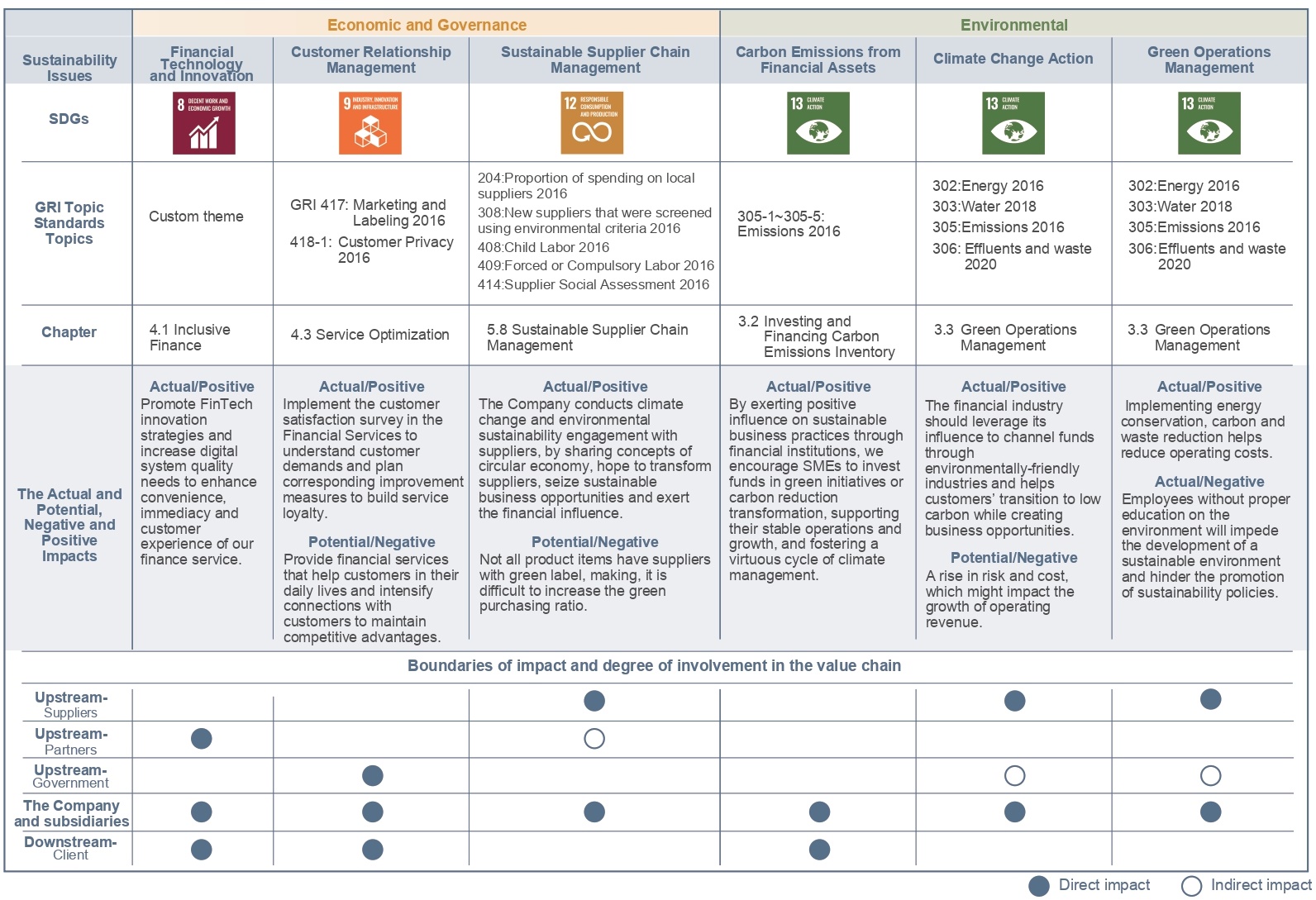

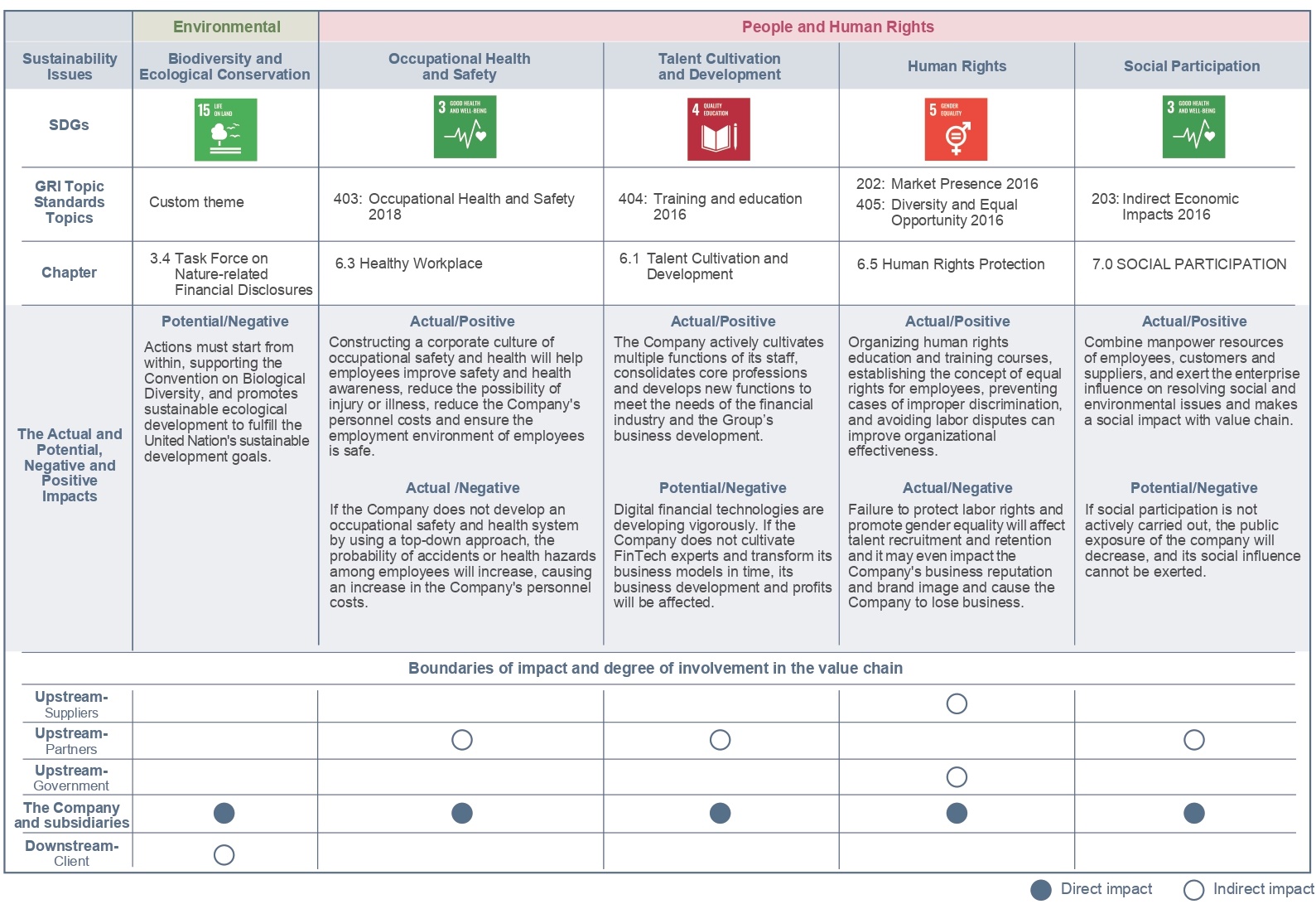

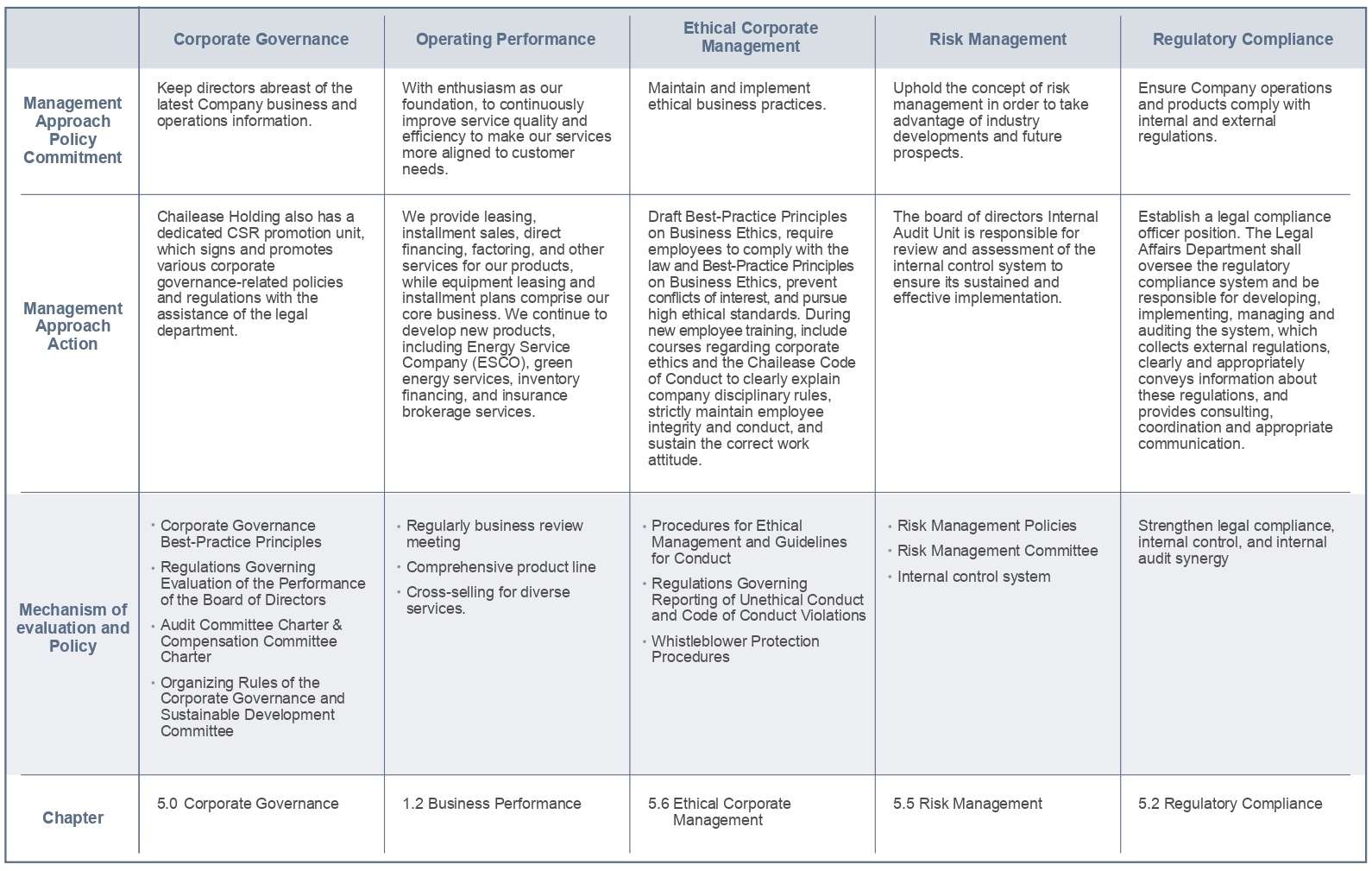

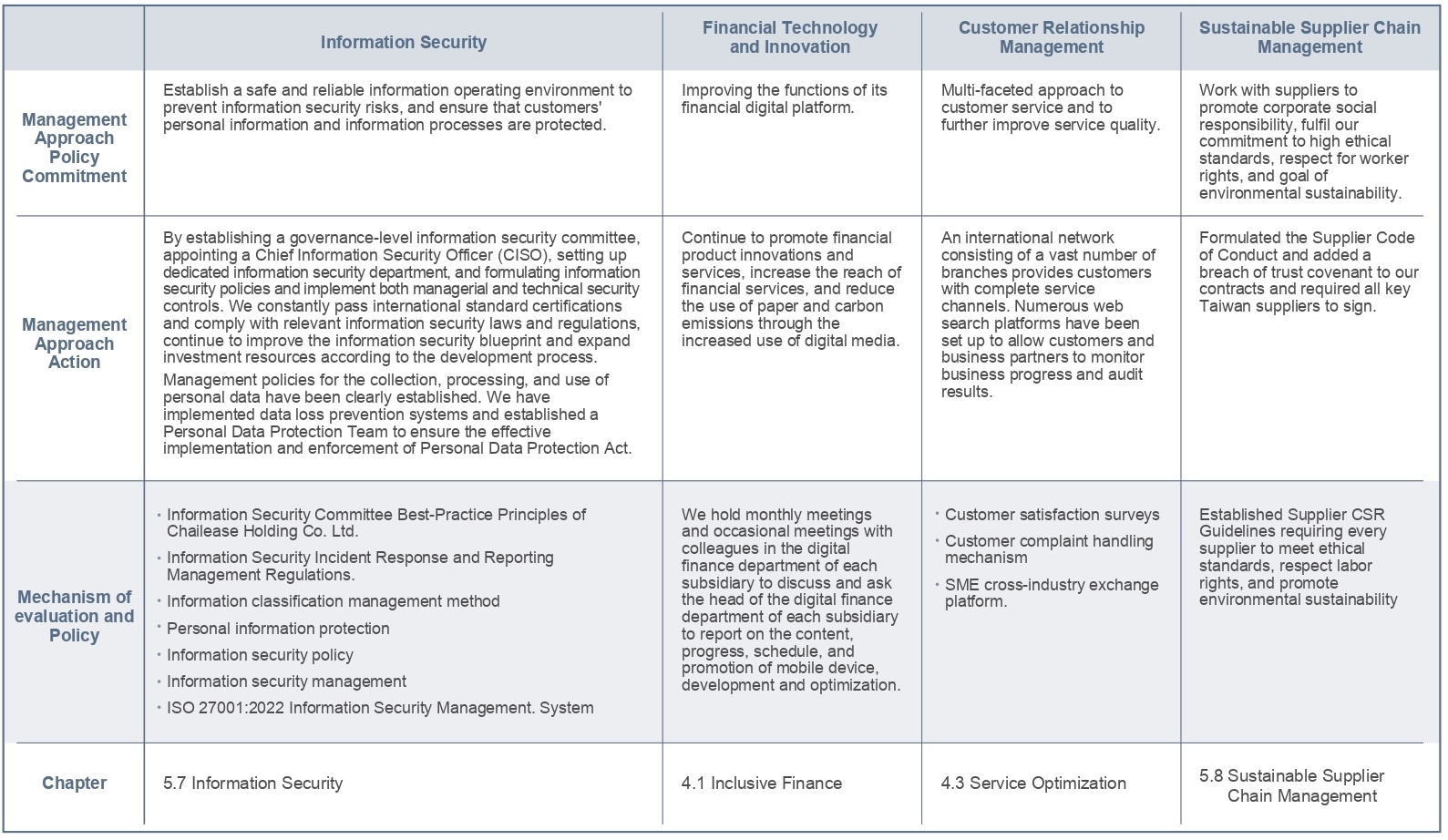

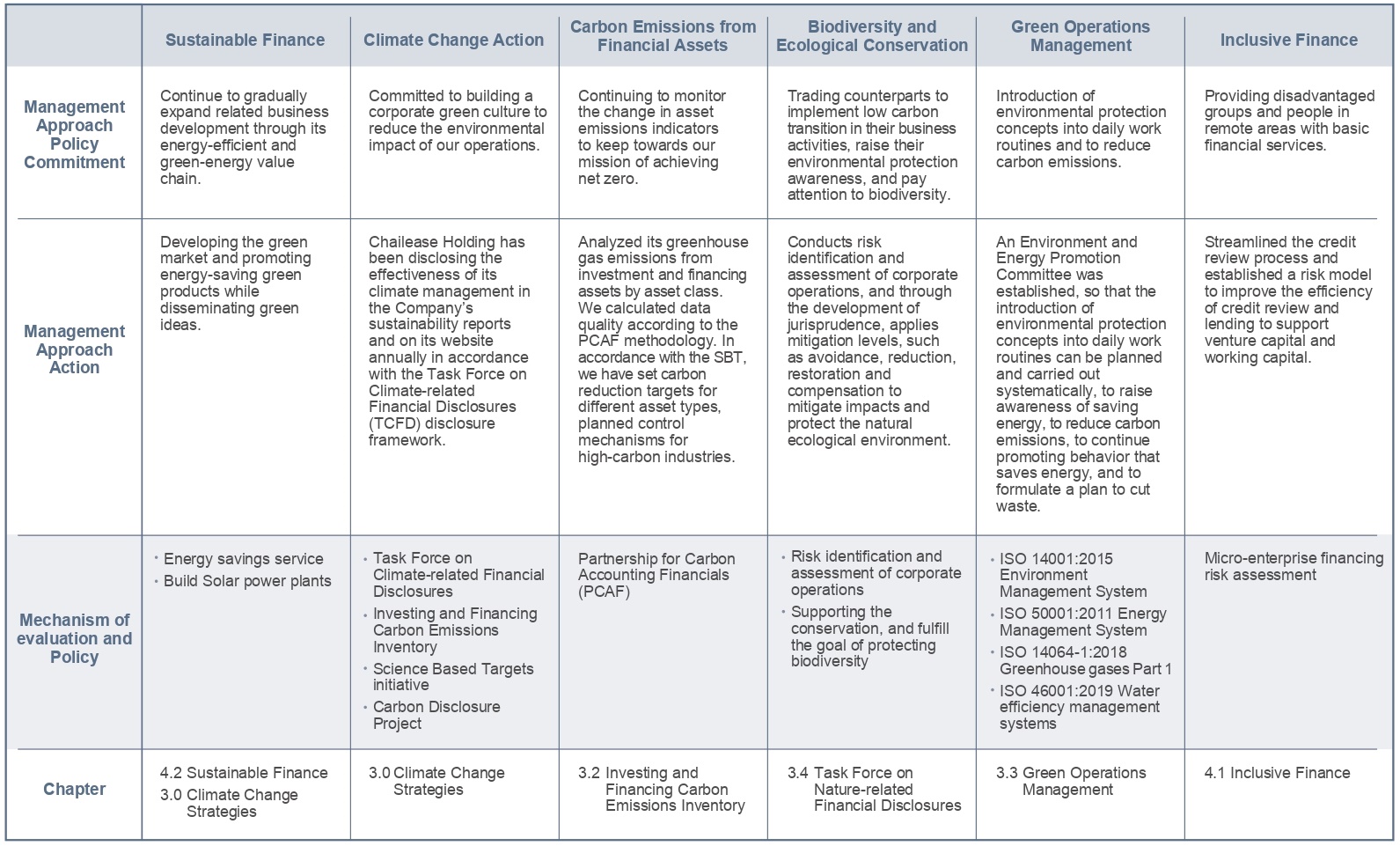

The opinions of stakeholders have served as the guiding principle for the development of the Chailease sustainable development strategy since the first CSR Report was published in 2013. The process of compiling the Environmental (E), Social (S) and Governance (G) issues of concern to stakeholders is used to internalize the issues as the corporate sustainability targets. Chailease also refers to international sustainability standards and regulations such as the GRI Standards, and SDGs Sustainability evaluations such as the DJSI, MSCI ESG Ratings, and the Chailease Holding's sustainable development strategy are adopted as the basis for materiality analysis for the identification of 5 material topics in four major dimensions including accountable governance, environmental management, social harmony, and happy workplace. The issues are internalized as the company's targets for enterprise risk management (ERM) & sustainable development organized as the basis for drafting reports. The results of the stakeholder agreement will be reported to the Corporate Governance and Sustainable Development Committee and the Board of Directors.

Engaging with Interested Parties

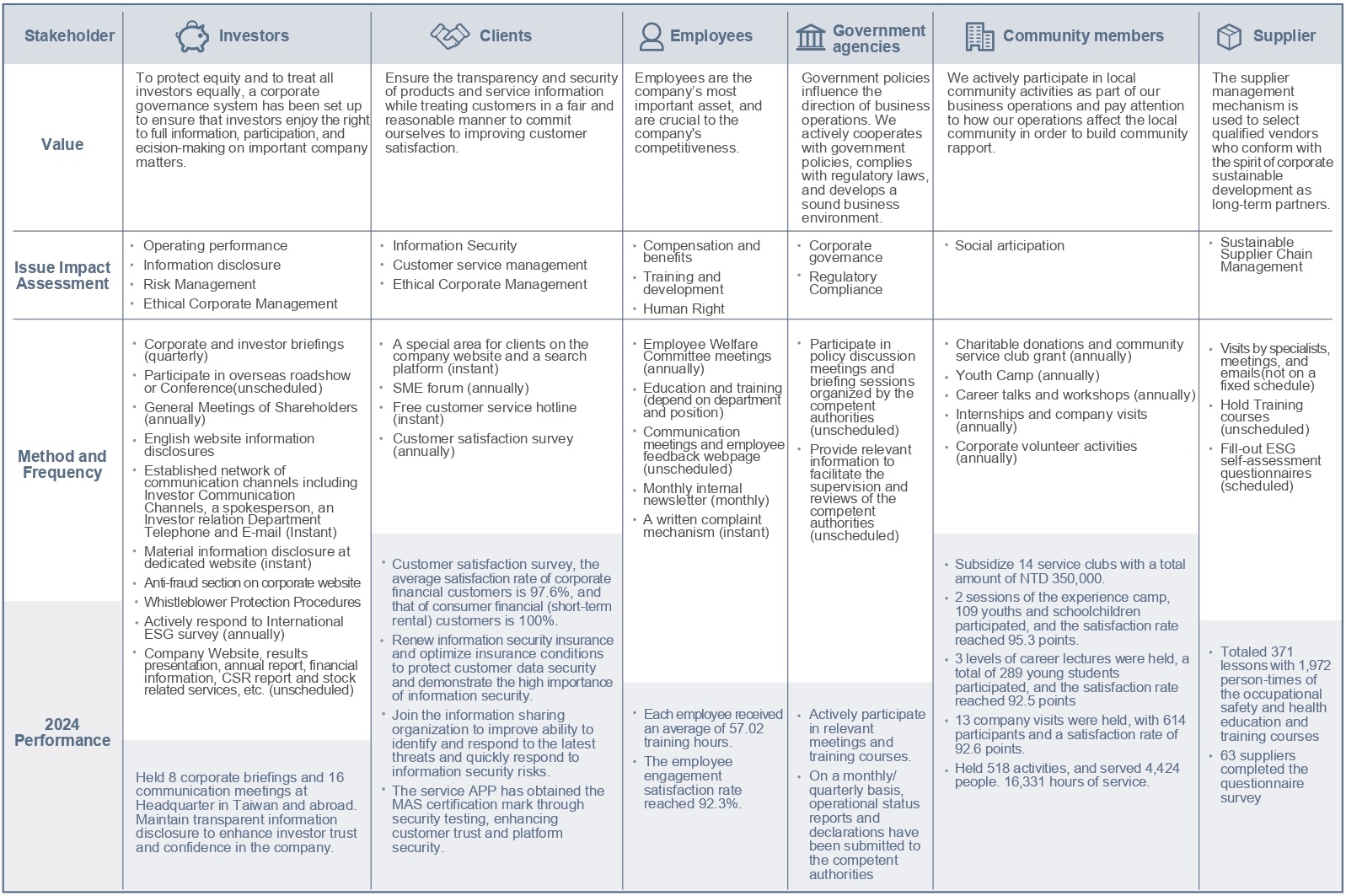

The company maintains a strong relationship with interested parties by engaging them through various channels of communications. This not only contributes to overcoming corporate issues but also brings the company closer to achieving its goals. Such engagement can also serve as the foundation for developing an approach to corporate sustainability and improving company performance across a range of areas.

As the industry has remained relatively stable, the stakeholder identification results from the prior year continue to apply. To effectively identifying key stakeholders, Chailease Holding made reference to the experiences of benchmark companies and industries and discussions among ESG group members from various departments in following the principles of the AA1000 Stakeholder Engagement Standard to assess the degree of “Dependency, Responsibility, Influence, Diverse Perspective, and Tension” on the part of stakeholders. After screening of the overall assessment, the main stakeholders were determined to be investors, customers, employees, government agencies, members of society and supplier